is a rolex tax deductible | roman sharf watches tax write off is a rolex tax deductible While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before . Zillow has 204 homes for sale in Centennial Hills Las Vegas. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place.

0 · roman sharf watches tax write off

1 · can you write off a rolex

2 · are luxury watches tax write off

3 · 10k rolex write off

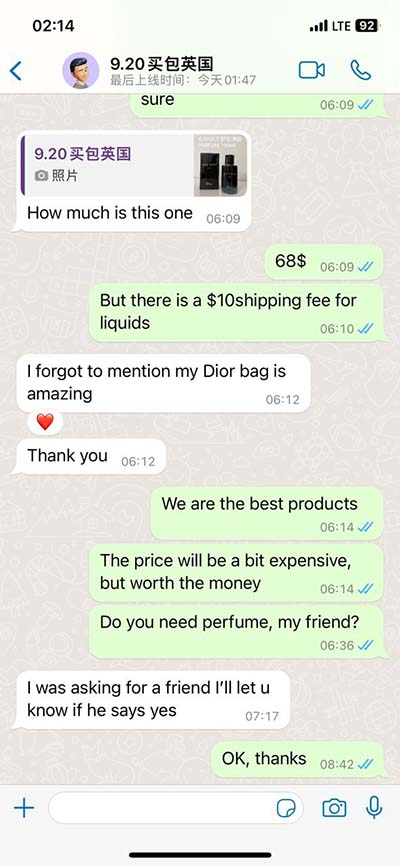

Louis Vuitton's cute Camera Box bag was recently spotted on the arms of two very different but supremely chic stars: Millie Bobby Brown and Taylor Swift. Hopefully, we can get our hands on one soon too. The bag appears to be rather small at first glance, but rest assured it fits all the essentials.

While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you. While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before . First and foremost, you have to remember—the IRS requires that for an expense to be deductible, it must be both "ordinary and necessary" for your business. An "ordinary" . Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering .

Giving yourself a fancy watch is absolutely not deductible because it’s not an “ordinary and necessary” expense required to operate the business. If you want to buy yourself stuff at . Despite popular belief and advice from some tax professionals and influencers, the IRS and tax courts generally do not allow deductions for Rolexes. The deductibility of clothing .

Absolutely, Rolex watches are viewed as a dependable asset because of their consistent track record in maintaining and potentially appreciating value over the years. One should give . The capital gains tax is different for collectibles than for stocks and bonds. 1)The basis for a collectible is the price paid plus broker fees plus restoration costs. 2)If you sell the .Indeed deduction is only worth x your tax rate. It will never make economic sense if you don't have charitable intent. Nobody would pay ,500 to save 0 on their taxes without .While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you.

While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find yourself in tax court to learn the hard way that you can't write off just anything. First and foremost, you have to remember—the IRS requires that for an expense to be deductible, it must be both "ordinary and necessary" for your business. An "ordinary" expense is one. Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering . The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101.

Giving yourself a fancy watch is absolutely not deductible because it’s not an “ordinary and necessary” expense required to operate the business. If you want to buy yourself stuff at company expense, then either raise your own salary, or give yourself a cash bonus.

roman sharf watches tax write off

can you write off a rolex

Despite popular belief and advice from some tax professionals and influencers, the IRS and tax courts generally do not allow deductions for Rolexes. The deductibility of clothing and accessories hinges on three criteria: being required or essential for .Absolutely, Rolex watches are viewed as a dependable asset because of their consistent track record in maintaining and potentially appreciating value over the years. One should give thought to acquiring both contemporary and vintage models.

The capital gains tax is different for collectibles than for stocks and bonds. 1)The basis for a collectible is the price paid plus broker fees plus restoration costs. 2)If you sell the collectible for more than you paid the capital gain is taxed at either your ordinary income rate if held less than 1 year; or if held at least 1 year the lower .

Indeed deduction is only worth x your tax rate. It will never make economic sense if you don't have charitable intent. Nobody would pay ,500 to save 0 on their taxes without charitable intent.While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you. While it may be bad news to find your Rolex isn't deductible, it's better to discover this now before you shell out the cash and don't get your anticipated tax break — or before you find yourself in tax court to learn the hard way that you can't write off just anything.

First and foremost, you have to remember—the IRS requires that for an expense to be deductible, it must be both "ordinary and necessary" for your business. An "ordinary" expense is one. Is a luxury watch a tax write off? In other words, can you deduct a luxury watch purchase as a business expense? Grey market watch dealer Roman Sharf of Luxury Bazaar made a video answering . The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one is 9101.

Giving yourself a fancy watch is absolutely not deductible because it’s not an “ordinary and necessary” expense required to operate the business. If you want to buy yourself stuff at company expense, then either raise your own salary, or give yourself a cash bonus. Despite popular belief and advice from some tax professionals and influencers, the IRS and tax courts generally do not allow deductions for Rolexes. The deductibility of clothing and accessories hinges on three criteria: being required or essential for .Absolutely, Rolex watches are viewed as a dependable asset because of their consistent track record in maintaining and potentially appreciating value over the years. One should give thought to acquiring both contemporary and vintage models.

The capital gains tax is different for collectibles than for stocks and bonds. 1)The basis for a collectible is the price paid plus broker fees plus restoration costs. 2)If you sell the collectible for more than you paid the capital gain is taxed at either your ordinary income rate if held less than 1 year; or if held at least 1 year the lower .

are luxury watches tax write off

how can you tell a fake audemars piguet royal oak

Cesvaine Palace is one of the largest and prettiest castle-styled palaces of 19th century Latvia. The Cesvaine hunting castle is a bright sample of eclecticism that combines the elements of Gothic, Romanesque and Art Nouveau styles.

is a rolex tax deductible|roman sharf watches tax write off